But Square's got a head start with getting its product in the hands of merchants (Paypal Here is currently only in limited release) and a myriad of partnership / M&A options. They'll have to match on transactions fees but they have some breathing room before Paypal Here is in broad release. No reason to do it any sooner, and some good reasons not to, which can be measured in dollars. If I were them, I would prep the match announcement and wait until the day Paypal Here is rolled out, to deflate the news hype. Probably not a coincidence that Square started to look for a fresh major round of funding ($250 million) in mid-April 2012, a bare month after Paypal Here was announced in March. If they're not planning on putting themselves up for sale, they'll need the capital base to compete. Matching transactions fees, consolidating and expanding their domestic base, and international expansion all cost money. Exciting times ahead.

|

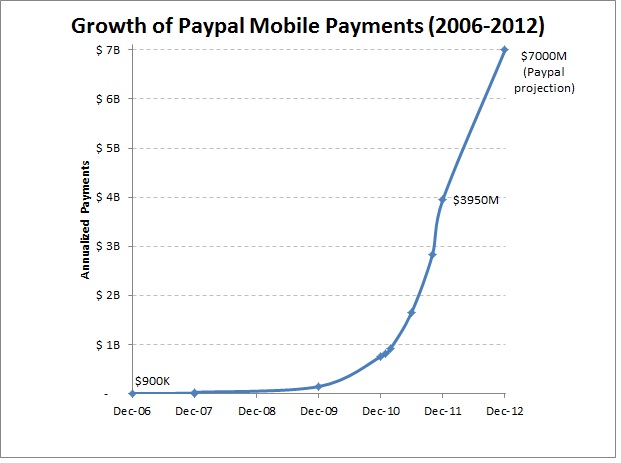

While I'm on the topic of mobile payments, here's some compiled data about the growth of Paypal, Square's major competitor, in the chart below. Paypal has global reach and experience, brand access to a network of 9 million merchants and 100 million users, the capital and financial flexibility to undercut Square on transaction fees by .05%, the whitespace to learn from Square's experience, and an Yves Behar-designed product in Paypal Here.

But Square's got a head start with getting its product in the hands of merchants (Paypal Here is currently only in limited release) and a myriad of partnership / M&A options. They'll have to match on transactions fees but they have some breathing room before Paypal Here is in broad release. No reason to do it any sooner, and some good reasons not to, which can be measured in dollars. If I were them, I would prep the match announcement and wait until the day Paypal Here is rolled out, to deflate the news hype. Probably not a coincidence that Square started to look for a fresh major round of funding ($250 million) in mid-April 2012, a bare month after Paypal Here was announced in March. If they're not planning on putting themselves up for sale, they'll need the capital base to compete. Matching transactions fees, consolidating and expanding their domestic base, and international expansion all cost money. Exciting times ahead. |

AuthorI'm interested in uncertainty, time, trust, consistency, strategy, economics, empathy, philosophy, education, technology, story-telling, and fractals. Archives

May 2016

My Favorite Curators Email newsletters Edge.org John Mauldin STRATFOR Futurity.org BPS Research Digest Domain-B.com FORA.tv PopTech! PIMCO Investment Outlooks GMO Client Reports Big Think Commonwealth Club Someecards.com MRN Research Papers Chicago Booth eNewsletters McKinsey Quarterly Boldtype / Artkrush Singularity University Charlie Rose The Aspen Institute Feeds WNYC Radiolab This American Life Freakonomics Radio The Moth Chicago Booth Podcast The Atlantic Council The Memory Palace TED.com Foreign Affairs The Ideas Project Long Now Foundation The School of Life Letters of Note Periodicals The Economist The Wall Street Journal The New Yorker The New York Times Wired Magazine The Atlantic Other Websites Oaktree Capital Memos LSE Public Lectures Bubblegeneration Becker-Posner Blog Eric Von Hippel NetAge John Seely Brown Malcolm Gladwell John Hagel HBR – The Big Shift LookBook.nu Robert Shiller Paul Graham Frontline PBS Royal Society for the Arts Blake Masters Humor Best of Craigslist Texts from Last Night FMyLIfe MyLifeisAverage Lamebook The Onion Categories |

RSS Feed

RSS Feed